While the a high 1% Inventor in the united kingdom, Joel is actually a reliable Dallas mortgage lender. He knows the need for responsive and you will experienced solution, particularly in a fast expanding area urban area particularly Dallas-Fort Worthy of. Brand new present You Census Bureau statement have Fort Worthy of rated given that fastest-increasing area in the us. And Site Choice Category gets the Dallas Metroplex as fifth fastest-broadening region town in the nation of the 2028!

Relocations always keep raining inside, that’s ultimately causing the lowest supply of homes for sale. Thus, home prices is right up. Whenever you are a first-day homebuyer, this fact may sound challenging. However, as much as possible pick a house, you really need to always pick a home. Joel Richardson has arrived to help you get a home loan to buy your fantasy home today.

Home loan Credit Made Issues-100 % free getting Residents in Dallas, Tx

Whether you get a home for the first time or is a highly-trained homebuyer, you should know you https://clickcashadvance.com/installment-loans-la/central to to acquire a home is fascinating and you can rewarding. During the Dallas and Fort Well worth, you can find mortgage options that you can use according to your role.

Antique, Repaired Speed Home loan

The rate cannot changes in the lifetime of the mortgage. For many homebuyers, minimal down-payment are 3%.

Government Property Government

A federal government-insured mortgage for these with limited income or bucks to have a downpayment. FHA fund likewise have fixed prices and lowest advance payment is actually step three.5%.

Veterans Products Mortgage

Positives previous and energetic armed forces team as well as their group. Va money are fixed rate finance and offer $0 down-payment choice.

Arm Financing

Varying rate financial otherwise Case where in actuality the payment is fixed for some years after which tend to to change following fixed speed months. Minimum deposit was 5%.

USDA Financial

United states Company regarding Agriculture (USDA) financial, which is also a government-recognized mortgage for people who are now living in faster locations and metropolises. USDA even offers $0 deposit but is money limited.

JUMBO Fund

Also known as nonconforming money due to the fact amount borrowed are high compared to the regulated limits having antique funds. Predict ten% down at the very least together with most readily useful cost require 20% off. One another fixed and you may changeable rates financing are offered for jumbo issues.

Dallas Home loans Made Stress-100 % free

You’re looking for home financing credit alternative within the Dallas as the need assist to acquire a property. At the same time, you would like the process to get as difficulty-100 % free you could. The lender will likely be people you faith. We know financial support your dream is a big contract, therefore you should find the right lending company for the Dallas, Colorado. Thank goodness, you really have arrive at the right place. Joel Richardson additionally the VeraBank class was right here to be certain your feel safe for the techniques.

We know one interest levels have a significant influence on their alternatives. Meanwhile, we make sure the procedure is simple, timely, and worth your own time. Information about how it functions:

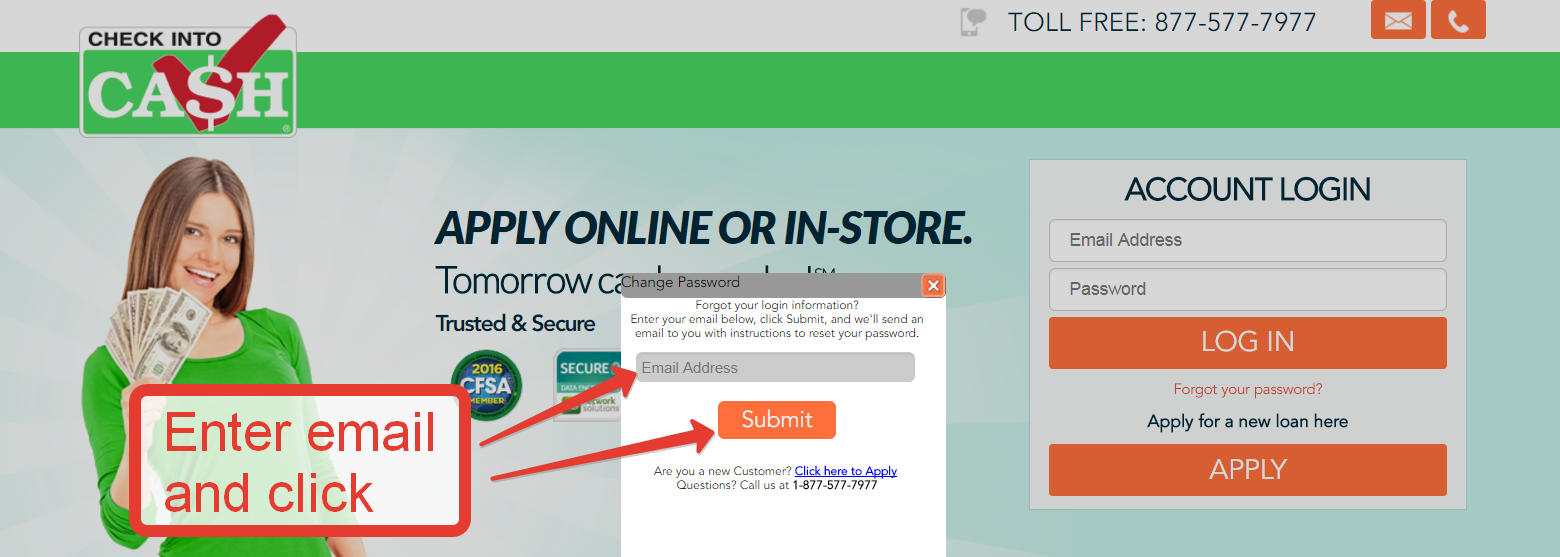

The initial step

Start by the application processes. It’s easy! You apply on the internet and it only takes a few momemts. The latest selection of effortless-to-learn concerns tend to head you together. You could potentially choose a price and will plus choose the newest advance payment. Immediately after pre-being qualified, we will give you that loan guess.

Step two

Out of my site, you could potentially upload data that people wanted in order to qualify your. Try to fill in essential files ahead of i go-ahead into the buy to manufacture an effective prequalification letter.

Step three

Once we normally material new prequalification, you’re on our house see! The realtor requires the latest prequalification* letter presenting a deal into provider. I performs give-in-hand along with your agent presenting the render on the provider. (*An effective prequalification isnt an acceptance out of borrowing, and will not signify you to underwriting standards have been came across. )