Home loan costs features strike the reduced point in more than a year and a half. And that’s huge development if you were looking at the latest homebuying sidelines waiting around for so it time.

Actually a tiny decrease in pricing could help you score a beneficial better payment per month than simply you would expect on your own 2nd domestic. And the drop that is happened recently actually quick. As the Sam Khater, Chief Economist at the Freddie Mac computer, says:

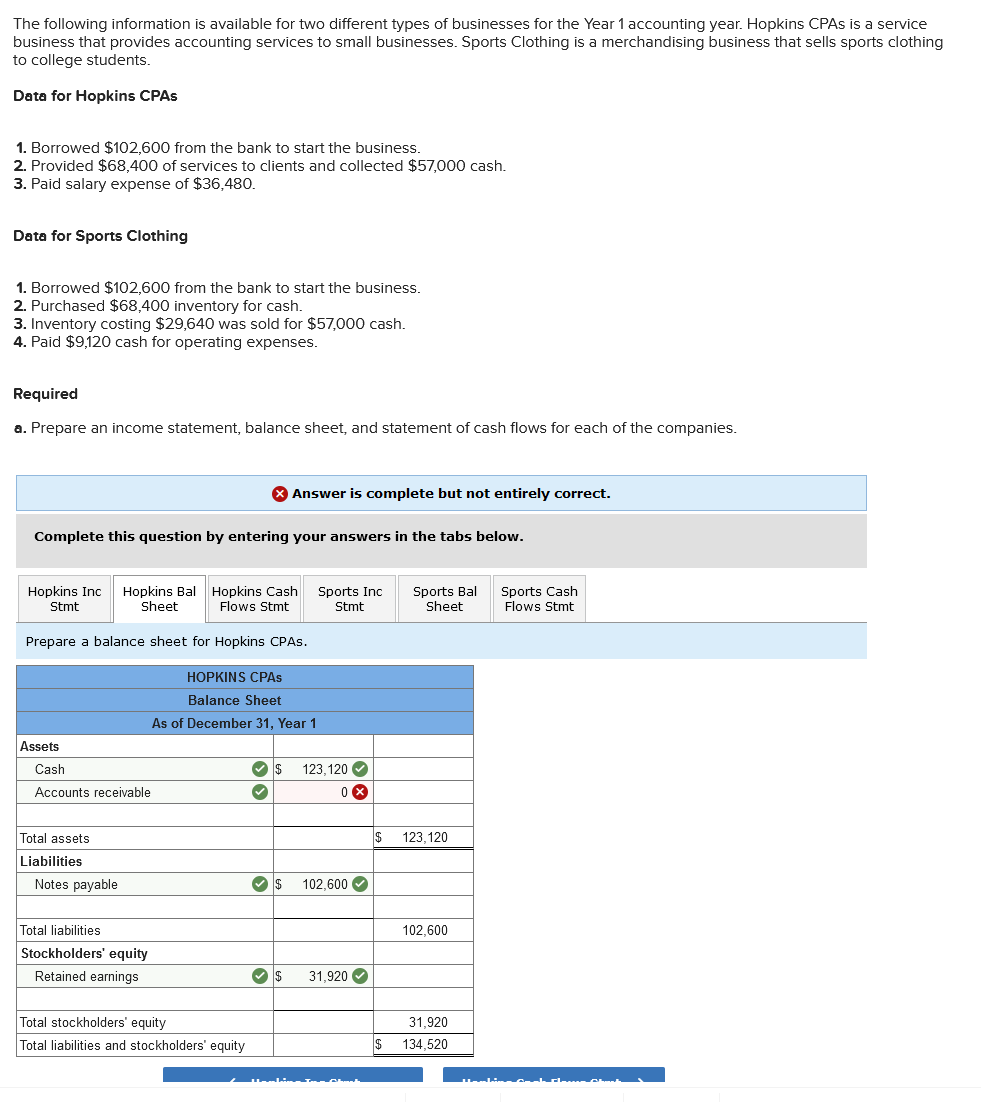

But when you want to see it to truly accept is as true, here’s how the latest math shakes out. Look closer within affect your own monthly payment.

The fresh graph less than suggests just what a monthly payment (principal and you can notice) carry out look like on the an excellent $400K mortgage for many who purchased a house back into April (the 2009 financial rate large), as opposed to just what it you certainly will feel like if you buy a house now (look for lower than):

Supposed from seven.5% but a few days ago toward reasonable six%s provides a giant influence on the bottom line. In a matter of months’ go out, the newest envisioned monthly payment with the good $400K financing has arrived off by more than $370. That is a lot of money smaller monthly.

Bottom line

On the recent shed when you look at the financial costs, the to invest in power you may have now is preferable to it’s been in almost 24 months. Let us speak about the choices and how you could make Oregon installment loans brand new a lot of which moment you have been waiting around for.

Copyright laws 2024 Washington Local Multiple listing service, Inc. All legal rights set aside. Recommendations Perhaps not Secured and ought to Be Confirmed by end User. Webpages includes live study.

Whenever you are thinking about to invest in property, your credit score is just one of the most significant bits of the mystery. Consider it just like your monetary statement card you to definitely lenders research from the when trying to find out for folks who meet the requirements, and you will and therefore financial will work best for you. Just like the Financial Statement says:

Good credit ratings express so you’re able to loan providers you have a tune listing having safely dealing with the money you owe. Ergo, the better their get, the higher your chances of qualifying for home financing.

The challenge try most people overestimate minimal credit history it must get a property. Based on a study of Fannie mae, just 32% away from consumers have a notable idea out of what lenders wanted. That means almost dos out of every step 3 people don’t.

The minimum credit score wanted to pick a property can range from five hundred to 700, however, will ultimately confidence the sort of mortgage loan you happen to be making an application for as well as your bank. Extremely loan providers want the very least credit score of 620 to buy a property which have a normal financial.

Although lenders fool around with credit scores eg Credit scores to greatly help all of them make credit choices, for each bank has its own approach, like the number of risk they discovers acceptable. There is absolutely no single cutoff get utilized by all the loan providers, so there are numerous other variables that loan providers may use . . .

Incase your credit rating needs a tiny TLC, don’t worry-Experian claims you will find some points you could try provide an improve, including:

step one. Pay The Debts on time

Lenders like to see to dependably spend their expense promptly. This can include many techniques from handmade cards so you’re able to tools and you may mobile phone costs. Uniform, on-big date money show you might be an accountable debtor.

dos. Pay back An excellent Loans

Repaying your balance can help reduce your total personal debt and work out you a reduced amount of a risk so you can loan providers. Including, it enhances your borrowing utilization proportion (how much credit you might be using than the your own total restriction). A diminished proportion form you might be much more reputable to lenders.