Dealers seeking to control its funding profile need to ensure that it strategy matches their full financial wants, and you will threshold for chance.

Share

Borrowing money right now to put money into the long run try a method of numerous winning dealers used to-arrive its private and you may economic wants – should it be to buy a home, purchasing a degree or performing a corporate.

A less common, however, equally pass-lookin technique for certain, are borrowing from the bank to construct an investment portfolio detailed with holds, securities and you will funding finance.

Taking up obligations so you’re able to secure expenditures may seem counterintuitive to a few although prospective productivity could be profitable when the over strategically, says Tony Maiorino, lead of RBC Loved ones Place of work Features group.

Credit is something somebody create each day – for an automible, a property or a secondary property, states Maiorino. Issue try, should you decide obtain to expend profit the avenues? The response to you to real question is even more cutting-edge.

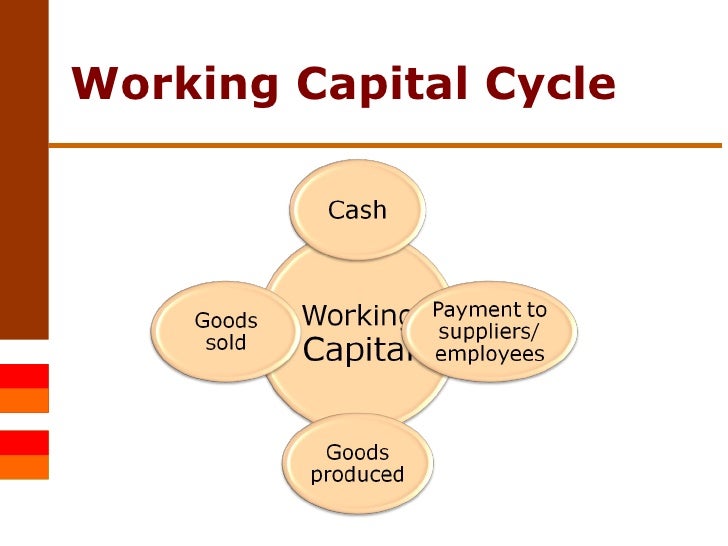

Credit to blow mode you could deploy large volumes out of money either in one go or over a period of time. The attention, of these committing to in public areas-replaced ties, could be tax deductible. One risk was a financial investment produced from borrowed currency get drop within the worth, which is a reduced amount of a concern if it’s a long-term flow. As well, the cost of the borrowed funds over the years may become higher than the brand new finances produced from it.

Maiorino states investors trying control its funding profile need certainly to make certain this plan suits its full economic specifications, and threshold having risk.

Done in a beneficial diversified and you may careful way, credit to expend can be as beneficial once the investing a beneficial family along side long haul, he states. In my experience, it is more about the individual and you may making sure the techniques is useful thing for them.

Based on a study held because of the Economist Intelligence Device (EIU), commissioned by RBC Riches Management, 53 percent off dealers during the Canada say increasing its wealth try a top money means.

This new riches ascending survey objectives higher-net-well worth anyone (HNWIs), mature people from HNWIs, and you may highest-getting positives across the Canada, the brand new You.S., United kingdom, China, Hong kong, Singapore and you may Taiwan. It appears on progressing landscape out-of international wealth, where wealth will be, just what it might possibly be invested in, the way it would be invested and that is purchasing.

In the Canada, 30 per cent away from younger payday loan Elba generations* state they obtain to spend, with 44 % preferring stocks and you can 44 percent preferring mutual finance.

Carrying out early to build wide range

Credit to spend may start prior to some body has generated up a sizeable financing profile, Maiorino says. For-instance, a trader within their 20s and you will 30s you are going to imagine credit to subscribe an authorized later years savings bundle (RRSP) from year to year. Deductible RRSP benefits can be used to dump individual taxation.

Dealers can then fool around with its taxation reimburse to settle a percentage of your own financing and, ideally, try to pay-off the others after in, Maiorino claims. The process can then feel repeated to create wealth.

Whenever you can afford it, and will result in the money, it is a no-brainer, says Maiorino, which used this strategy before in the job to develop his personal money collection.

The thing you simply cannot go back are go out, Maiorino says. For individuals who begin advancing years offers from the twenty-five, by the time you might be 35, you’ll have 10 years of investment, including one collected growth. That’s some thing somebody who begins expenses during the age thirty five is actually never gonna provides.

Borrowing to expand your own money

Shortly after an investor enjoys a considerable financial support collection, they could need to borrow secured on they to help you assist expand its money. Ann Bowman, head away from Canadian Private Banking from the RBC Money Management, states this can be an alternative best-suitable for traders more comfortable with risk, along with a conviction they could build increased get back versus cost of the loan.