Just what are mutual mortgage applications?

Expensive home values and you can increased financial rates are making affordability a challenge for almost all homebuyers. Thank goodness, shared home loans mix financial resources and certainly will make qualifying to possess a mortgage notably easier.

If you find yourself thinking about to acquire a house which have others, you ought to understand how shared mortgages really works. When you are mutual mortgage loans have numerous advantages he’s got specific possible disadvantages to take on, also.

What’s a joint loan?

A combined financial occurs when several some body get a home loan with the purpose of getting property. Per applicant’s income, credit history, and you may finances and factored with the deciding the qualification toward financial and also the loan amount.

This type of home mortgage often is utilized by couples, loved ones, family members, if you don’t organization couples who wish to buy property to one another.

Shared mortgage borrowers share the burden getting paying off the loan which have others applicants. However, unless discover shared tenancy otherwise complete combined control definition the activities take the loan in addition to label singular class get it is very own the house.

To the a mutual home loan, both you and another financial borrower’s fico scores can come for the enjoy. The financial usually remark each of your credit ratings of every around three of big credit bureaus and find out which is actually the brand new down center score.

When you decide towards a joint financial, the best idea is to look at the fico scores early. Providing methods to switch your own fico scores can result in a beneficial ideal home loan rates and lower commission.

If you learn your co-borrower features less than perfect credit, you may want to believe searching for a different co-debtor, or watching whenever you qualify yourself.

Who qualifies to have combined mortgage loans?

Really loan providers undertake combined mortgage software. Rarely create lenders features particular standards as to who’s welcome into a combined financial.

Are not, mutual mortgages was acquired because of the married couples. When a couple enter into a married relationship, otherwise equivalent partnership, earnings usually are mutual. Very, it may sound right to fairly share the duty out-of home ownership, such as the financial.

Qualifying criteria for a combined financial software program is like those for personal financial apps. To own old-fashioned finance, while you are financial assistance can differ some, very require following the:

- Credit rating from 620 or maybe more

- Minimal deposit regarding 3% – 5%

- Debt-to-earnings ratio out of forty% – 50%

- A career records and you will verifiable money

- Amount borrowed that’s at the otherwise beneath the compliant mortgage limitations (already $726,two hundred in the most common portion)

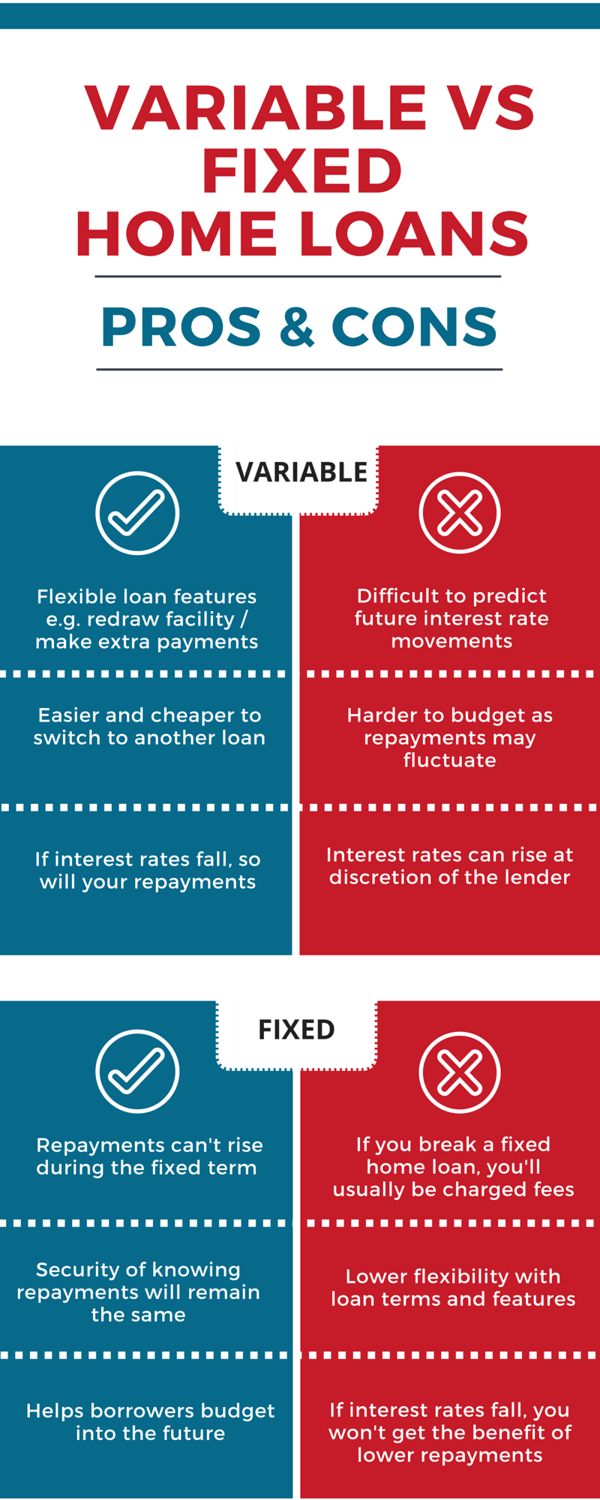

Benefits off combined mortgage loans

Shared mortgages might have many advantages. They bestow homeownership to your those who can get or even perhaps not be eligible for a loan because of not enough borrowing or earnings.

Since economic burden from month-to-month mortgage repayments is actually common, it can make it cheaper and you can down for everyone events. Shared mortgage loans may also provide income tax pros, such as for example common write-offs getting mortgage notice and you may property fees.

Company people or family unit members get pursue a joint financial because good way of getting into the real estate investing. Pooling your resources might create rental money or make the most of this new home’s fancy.

An additional benefit so you can a mutual mortgage is that you may have the ability to acquire over you’ll be able to if the borrowing from the bank yourself. Loan providers blend all of the revenues to the mutual financial programs to decide how much it’s also possible to qualify for.

Drawbacks of combined mortgages

Joint home loan can also come with potential challenges. These downsides can be meticulously experienced before stepping into a great joint mortgage contract.

Even though you try everything proper, help make your part of the common money timely, etcetera. there’s absolutely no make sure your own co-borrower perform an identical. If you have a failure when you look at the correspondence otherwise unanticipated alterations in facts, eg divorce case or jobless, most of the events will be influenced.

It is very important just remember that , all borrowers take brand new link in case of standard. If an individual borrower does not make share of your commission, the remainder borrowers need defense the lack.

Not only will defaulting negatively impression everyone’s borrowing and you may potentially head in order to judge effects, elite group and/otherwise individual matchmaking is inspired will be either people fail to last their stop of the contract.

Also, crucial behavior regarding your possessions have to be decideded upon of the the events. This type of common choices are cash advance using prepaid debit card placing a connection into the domestic, when to sell as well as for exactly how muching to a mutual arrangement to the including large factors could well be difficult.

How to determine if a mutual financial is right for you

One of the most significant benefits associated with delivering a combined mortgage was it means you’re capable pick or very own a lot more household than just you could potentially your self.

But it’s important that each and every cluster is during full contract when you are looking at the latest conclusion towards domestic, together with common requirements.

Bear in mind that being a co-borrower on the a joint home loan could impression what you can do locate other fund. Generally, when trying to get other forms out-of borrowing, the entire homeloan payment is known as your obligations. This will be it doesn’t matter how the latest monthly mortgage repayments is actually shared.

Most readily useful individuals to own joint mortgage loans become people who currently show financial duties. Partners or lifetime couples – or those who already cohabitate and you can express financial passion – tend to be safer co-consumers.

As much as possible be able to pick a property having higher loan words, this may generate significantly more sense to cease the potential risks of incorporating co-individuals and only go on they by yourself. Your lender you certainly will help and you can answer any questions you could keeps.

The bottom line towards joint mortgages

Mutual mortgages feature the main benefit of merging the money and you may possessions of several consumers, possibly increasing your borrowing from the bank electricity and you can value.

A mutual home loan together with comes to shared accountability, not. Ahead of typing a joint mortgage arrangement, every functions would be to cautiously consider all experts and you can potential drawbacks. Discover communications and faith are foundational to.

Don’t forget to consult the bank throughout the whether your qualify your self, or if perhaps a shared financial can be your best option.